It has been six months since we published our report examining the risks and opportunities of fiscal devolution to the Welsh tax base. Our discussions with tax policy colleagues in the Welsh Government and experts and academics from across the UK threw up plenty of issues which couldn’t all be fully explored within the parameters of our research, and developments and discussions since its publication have been far broader than the headlines. We have therefore invited guest bloggers to expand on some of these wider tax policy questions.

In this blog, Daria Luchinskaya and Nikos Kapitsinis consider non-domestic rates, or business rates, and any greater contribution they could make to public revenues in Wales.

What are non-domestic rates?

Non-domestic rates (NDR) are a tax on non-residential properties, such as schools, shops, offices, hotels and other premises and buildings. In Wales, NDR is set by assigning the NDR multiplier (linked to inflation and set by the Welsh Government) to a property’s rateable value (set by the Valuation Office Agency).

The contribution made by NDR revenue to Welsh local government annual income has been steadily increasing from 10.9% in 2011-12 to above 12% in 2016-17, at a value of around £1 billion.

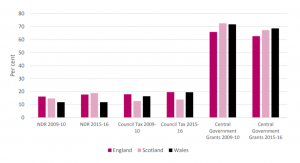

Sources of Local Government revenues as a percentage of total Local Government finance

Source: ONS (2011; 2016), Scottish Government (2011; 2017a), and for Wales: Financing of gross revenue expenditure and in-year council tax collection. Note: Central Government Grant includes the Council Tax Benefit before 2013-14, and Council Tax Reduction after 2013-14.

Source: ONS (2011; 2016), Scottish Government (2011; 2017a), and for Wales: Financing of gross revenue expenditure and in-year council tax collection. Note: Central Government Grant includes the Council Tax Benefit before 2013-14, and Council Tax Reduction after 2013-14.

NDR raised in Wales used to be pooled with revenues generated in England and redistributed to Wales. However, from 2015 responsibility for NDR was devolved to the Welsh Government, and today all NDR revenues are collected by Welsh councils and are pooled by the Welsh Government, which then redistributes the revenues back to Welsh councils, according to their population. This redistribution acts as a mechanism to reduce inequalities between councils that have high/low and fast/slow growing tax bases.

Alleviating regional inequality

Some Welsh councils receive more business rates income following redistribution than they contribute (positive difference), whereas for other councils their contributions exceed the settlements (negative difference). In particular, Cardiff’s properties account for around one fifth of all Welsh rateable values, with a negative NDR difference of about £30m a year. This current model of NDR redistribution is designed to reduce disparities in regional and local spending capacity and as a result the funding of public services.

In Wales, debate around NDR has often focused on relief schemes to mitigate the impact of business rates on small businesses. However, as models of local retention of NDR have been adopted in England and Scotland as a means to incentivise economic and business growth, the issue is gaining a profile here too.

Retention or redistribution – is there a middle way?

NDR retention may be a way of encouraging councils to grow their tax bases, but without corresponding protections, 100% council-level retention would lead to widening regional disparity. In our report, we discussed whether a partial retention scheme at the City Region level might represent an alternative way forward. We suggested two approaches:

- First, setting a City Region baseline business rate target, e.g. on the basis of business rate revenue growth trends, and each regional partnership would retain the agreed portion of the revenues in excess of the target. This approach would focus on the overall growth in economic activity as reflected in business rate growth and is a version of the approach applied to NDR in Scotland.

- The second approach would involve the retention of half of the business rates revenues yielded by any specific developments resulting from city region investments, i.e. new buildings or other tangible assets created through the growth deals. However, aside from the difficulties of attributing capital projects directly to growth deals, this ‘project-based’ approach could skew plans in favour of developing capital projects over other important social or infrastructure initiatives.

Two key issues are worth considering. First, there is a crucial trade-off between redistribution and incentives to grow a region’s (and council’s) tax base. The more the NDR system results in redistribution, the more control exists over managing regional disparities, but the lower the incentive to grow the tax base. The more an NDR retention system incentivises growing the local tax base through retention, the winners and losers will become more apparent. Second, what impact would NDR retention have on other local government income and Welsh Government revenues?

The devolution issue highlights the risks of a divergence in revenue growth between England and Wales. Historically, growth in the Welsh rateable property base has been broadly in line with that of England. However, the Welsh Tax Base report pointed out that key differences in the NDR tax base between England and Wales in terms of sector and industry could increase the risk of a divergence in NDR revenue growth rates between the countries, particularly should certain industries decline as others expand. Such a divergence could impact the Welsh budget, as changes in business rates income in England influences the size of the Welsh block grant through the Barnett formula.

Reform in the round

In April 2018 the NDR multiplier changed from being linked to the Retail Price Index (RPI) to the lower Consumer Price Index (CPI), which has meant lower taxes for businesses, but also lower revenues to fund public services. Today’s devolution of broader tax powers means that the Welsh Government needs to revisit tax structures and policy in the round. As part of this it intends to explore potential NDR reforms, including the possible replacement of NDR by a land value tax.

Ultimately, as the longer-term future of business rates is being questioned, we think that the issue of risk and detriment is crucial. For no local authority to lose out, any retention scheme has to be a) relatively modest in scope, and b) authorities have to be adequately protected while trading off that protection against the incentives to take on some risk and to grow their tax bases. We recommend that policymakers should aim to strike an appropriate balance between incentives to grow the tax base and regional economic performance on the one hand, and redistribution to minimise regional inequality on the other.